Love the Volatility

From its source on the Tibetan Plateau, the Yangtze River winds its way 3,900 miles through China and terminates near the mega-city of Shanghai.

The Yangtze is one of the world’s longest, most powerful rivers. For more than 2,000 years, it has played a key role in Chinese history as a source of drinking water, a crop irrigator, and as a transportation network.

Although the Yangtze has supported lives, it has ended many others. In 1931, torrential rains caused the Yangtze to flood its banks, which wiped out crops and lead to the deaths of an estimated 3.7 million people, making it one of the deadliest natural disasters in history. In 1954, another round of flooding resulted in the deaths of more than 30,000 people.

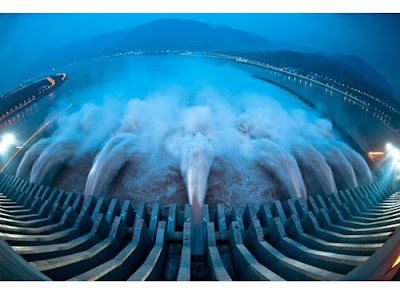

In the early 1990s, the Chinese decided to harness the Yangtze with a huge dam. At over 1 mile long and almost 600 feet tall, the Three Gorges Dam is the largest hydroelectric dam on earth. It cost more than $30 billion to build and produces awesome amounts of electric power. It’s also a key part of the Yangtze flood-prevention system.

To this day, the Three Gorges Dam stands as a monument to mankind’s ability to harness powerful forces and direct them towards productive means.

We’ve harnessed rivers like the Yangtze. We’ve harnessed powerful animals to pull ploughs and waggons. We’ve harnessed the power of the atom to produce nuclear energy.

So as an investor, why should you sit in fear of volatility… instead of joining in mankind’s legacy and harnessing its extraordinary power to build wealth?

This Could be a Landmark Moment for You…

To most investors, “volatility” is a bad word. It’s like a habanero pepper in your oatmeal. You don’t want to see it in your sensible, conservative investment mix. The talking heads on financial television bemoan volatility. Mainstream headlines make it sound like a terrible thing.

And this brings up one of the greatest lessons you can ever learn about the financial markets…. one of the true keys to market mastery.

Great investors and speculators treasure volatility.

As a professional investor, I love volatility. I owe much of my success to this “dirty word’ of the financial world. In fact, I believe it’s a landmark moment in an investor’s career when he/she realises that, much like a powerful river, volatility can be harnessed, directed, and used as a tool. When that realisation happens, a world of huge opportunities opens.

Many of these opportunities will come from the extremely volatile market.

If you know how to harness this market’s volatility and put it to work, you can make extraordinary returns in stocks.

You can make returns in 10 months that most people wait 10 years to make.

Most financial advisors will urge you to avoid volatile markets like the ones I’ve described. I agree with them. Armchair investors have no business trying to navigate these rapids. These folks are best served by regularly buying shares in low-cost index funds, settling for average returns, and getting on with their lives.

But what if you’re willing to do extra work to earn extra returns? What if you’re interested in being better than average… like 10 or 50 or 100 times better than average?

Well, then you might consider learning how to harness the market’s volatility and using its extraordinary power to generate wealth for you.

Learn to appreciate a good crisis

Boom. Bust. Repeat.

That’s the nature of a volatile market. And while booms can be great, you must learn to appreciate the busts as well. You need to learn to appreciate a good crisis. That’s when you sow the seeds of big bull market gains.

Markets are rational most of the time. They price most assets correctly most of the time. But when emotion levels go off the charts – like they do in a market crash – emotion completely overwhelms reason.

During crashes, terrified investors sell assets with no regard for their underlying values or ability to produce cash flow. This creates an environment where the price of assets becomes “unhinged” from the value of assets. This, of course, means you can buy bargains during a crash. If you can keep a level head while others are losing theirs, you can buy at fire sale prices.

When most investors hear about a crash in a market, their instinct is to sell or completely avoid that market. But if you’re interested in profiting from volatility, you must develop an instinct to buy into those kinds of markets. You must learn to run towards crisis. A crisis is about the only time you can buy valuable assets at extreme bargain prices.

If you’re new to the markets, it’s easy to get scared of volatility. The media certainly makes it out to be a bad thing.

But I’ll state again for emphasis: I believe it’s a landmark moment in an investor’s career when he/she realises that, much like a powerful river, volatility can be harnessed, directed, and used as a tool. When that realisation happens, a world of huge opportunities opens.

Many of these opportunities will be in the volatile markets. If you learn how to harness this volatility and put it to work, you can make it a source of huge capital gains for years to come.