Applying Science To The Art Of Investing

Successful investors call investing an art, but in reality, most apply well established scientific principles to win in the market.

In this short essay, we explore scientific practices and their application (wrong and right) to stock market investing. This is neither prescriptive nor comprehensive in its approach but an attempt to provoke thinking about how we manage portfolios and money.

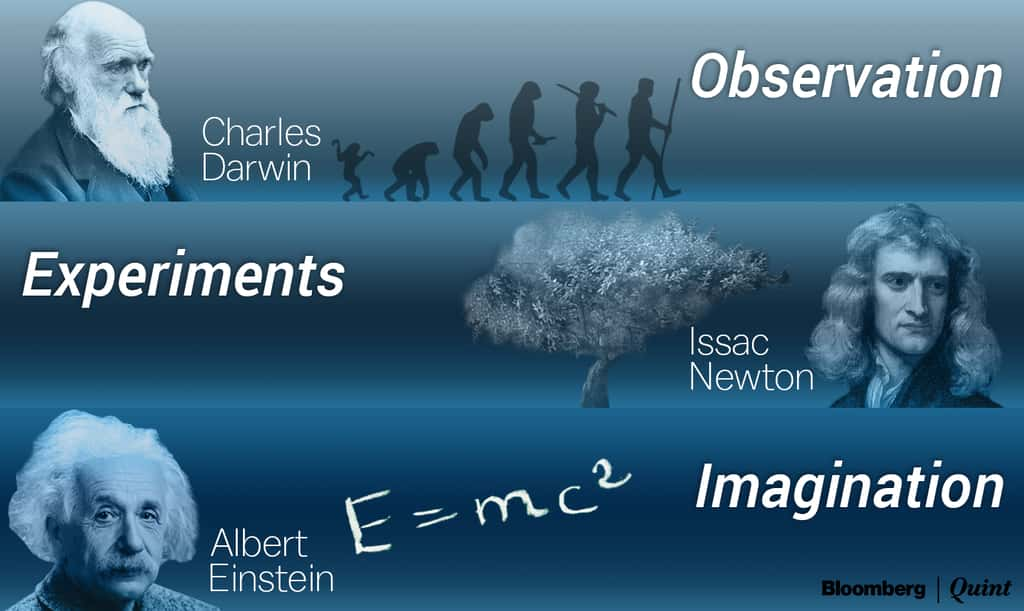

There are three scientific approaches: The approach of observation popularised by Darwin. Darwin observed things around him and came up with the theory of evolution. The approach of experiments, which entails conducting experiments to postulate theories. Newton's and Galileo's experiments on the behaviour of matter are classic examples of the use of experiments to evolve theory. The approach of imagination or thought is a third way to postulate a scientific theory. Einstein imagined the theory of relativity – it wasn’t until decades later that the science world proved Einstein's theory. In the stock market too, investors and analysts use observation, experiments, and imagination to construct portfolios.

How I Wish I Was Tossing A Coin

Investment by observation is the most common approach. We use historical data to arrive at conclusions about the future. But this is a faulty approach in our view since the historical distribution of share price returns may bear little resemblance with future distribution, unlike the toss of a coin.

Yet it is a popular method because of ease of use, as well as the confidence it generates through quantification of likely outcomes.

Market Participants Know The Future In Advance

Conducting experiments is difficult in stock markets since live markets are not subject to alteration of factors or inputs as in science experiments. In science, inputs can almost be changed at will to test results in a different environment. Stock markets do not permit this. What we can observe is historical behaviour and fit the observations to a proposed experiment. This process is prone to magnified errors since the fitting is usually done to prove a prior conclusion.

Beauty Lies In The Eye Of The Beholder, But Stock Returns Don’t

In contrast, imagination is a powerful tool in stock market investing. That said, ex-post proof of imagination is not subject to testing like in physical sciences. This leaves us with a lot of thumb rules that seem to work but proof remains elusive. A classic example is the PE frown. It postulates that low PE and high PE stocks tend to under-perform the market most of the time over longer durations – the sweet spot for PE valuations is in the middle – low PE stocks under-perform because the market is efficient and knows that the underlying business is not attractive whereas high PE stocks miss the market since a lot of the future growth is in the price. This theory is very appealing but the temporal evidence is missing. Imagining creatively about how businesses can evolve is an edge in stock picking, but hardly a guarantee of better returns.

Applying Scientific Principles

All this does not mean that the markets are not subject to scientific principles. These principles straddle areas ranging from biology and mathematics to social sciences. So let us see what we can borrow from the various sciences to apply to stock picking (far from an exhaustive list and certainly not prescriptive):

- Evolution theory: Time cooks share price returns. This works both ways but in the end, given that the market pays an equity risk premium for owning equities over the truly long run, in a portfolio context, time is an investor's friend, as it is for a surviving species.

- Medicine: As in medicine, every patient is idiosyncratic, so in stock picking, every investment is unique. Like doctors, avoiding the generalisation trap is the insight from medicine with application to stock picking.

- Mathematics: Continuous compounding, which long-term investors are so familiar with, was something that Jacob Bernoulli discovered. His insight was that for an annual interest rate or return of R (expressed as a percentage) for T years will yield a value of e^RT at the end of T years with continuous compounding. Compounding is the secret of wealth creation and its principle and discovery is rooted in mathematics.

- Probability theory: Return distribution is not normal (Bell curve). Stock returns more likely follow a Pareto distribution and non-linear path. This means risk management yields superior returns.

- Psychology: Making money in stocks is about managing greed, fear, boredom and envy – very basic human emotions. Being aware of them creates two advantages – avoiding mistakes and capitalizing on the crowd’s follies.

- Physics: Ultimately, Einstein challenged Newton’s insights on gravity. What operates at the gross level is different from the finer level, even though there is interdependence. Macro and micro in stock markets have a similar relationship. Professional stock pickers have a disdain for the macro approach, and vice versa. Flexibility is the best tool in this regard.

- Decision theory: Path dependence is crucial to stock market investing. Washing a shirt and then ironing it gives a completely different result from ironing it and then washing it.

- Information theory: This made Claude Shannon the father of the Internet but it also inspired John Kelly to engineer the Kelly Criterion, which arguably remains the most potent tool for portfolio managers.

- Bayes’ Theorem: This describes the probability of an event based on prior knowledge of conditions that might be related to the event or, essentially, when the facts change, the opinion should also change.

In the end, we quote Sir Isaac Newton who upon losing a princely sum of 20000 pounds in the South Sea Bubble of the 18th century said,

I can calculate the motion of heavenly bodies, but not the madness of people.

---------------------------------------------------------

CREDIT: BloombergQuint