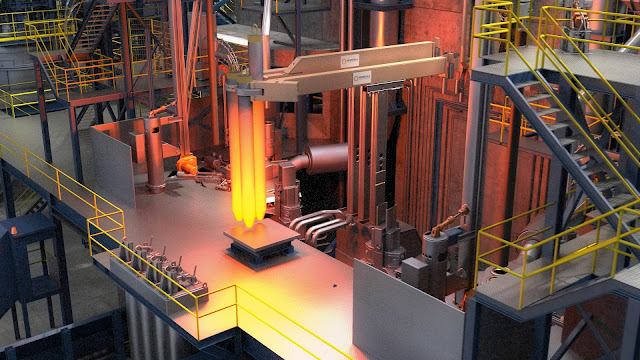

Graphite electrode - other side view

Recently, Indian graphite electrode manufacturers cornered investors’ attention with fundamentals pointing towards a turnaround in the sector. Key manufacturers in India – HEG and Graphite India

Graphite electrode manufacturers are the key beneficiary of the improvement in its end market - global steel demand. Industry consolidation leading to lower supply and higher barriers to entry is also positive news.

However, a sharp surge in raw material prices and China exports are the factors to watch out for which can cap this upside. Further, our calculations suggest that stock prices of both HEG and Graphite India are trading ahead of the expected pricing dynamics in medium-term.

Industry-wide capacity consolidation – lower supply

In the last few years, the global graphite electrode industry had witnessed curtailment of capacity (by 210 k tons) on account of weak profitability. Major companies like SGL Carbon and Graftech downsized their capacity by 100 kT and 60 kT, respectively. This has brought the global capacity (excluding China) to near 810 kT.

Key global graphite electrodes manufacturing companies (kT)

Source: Graftech,

Source: Graftech,

Improving supply-demand dynamics

Further, global demand for the graphite electrode is aided by improvement in end market. As per estimates from Graftech, approximately 1.7 to 1.8 kg of graphite electrodes are required to produce one ton of steel through the electric arc furnance route. Going by that, global demand for graphite electrode comes close to 742 kT. Now this is close to global capacity (excluding China) of about 810 kT which is of better quality compared to the one in China and considered better suited for high grade electrode manufacturing.

Graphite electrode demand in 2016

Source: World Steel Association,

#EAF: Electric Arc Furnance

Chinese electrode exports remain a big swing factor

Having said that one of reasons behind recent rally in graphite electrode has been on the back of news flow that there has been a clamp-down in the graphite electrode manufacturing capacity in China on account of stringent pollution norms.

Platts had earlier reported that China is on its way to cut graphite electrode capacity by around 50 percent. However, what is noteworthy is that going by the data points a good chunk of capacity was already lying idle.

Further, the impact of such steps by Chinese government on the exports of graphite electrodes are yet to be seen. Latest data from UN Comtrade suggests that the export run rate in 2017 has actually increased to a level prevailing in 2015 (2016 was weak). Indian exports have also increased in terms of volume close to that prevailing in 2014.

Thus, Chinese exports would remain a key data to watch to assess if there is further upside left for the Graphite electrode prices on account of supply crunch.

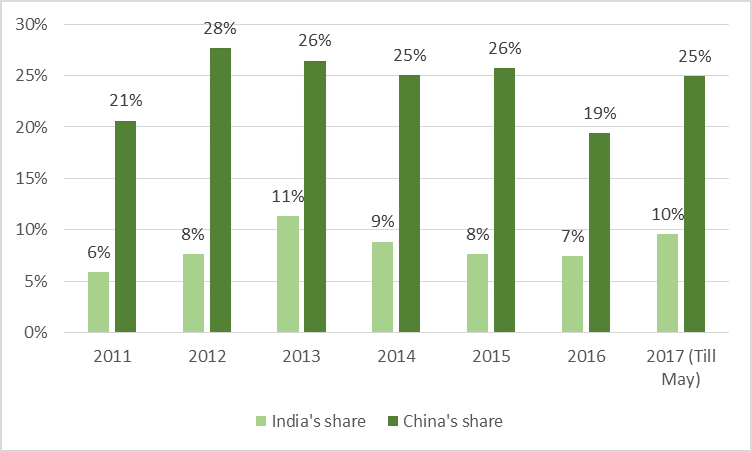

Export share in terms of quantity

Source: UN COMTRADE,

Shift in steel production from China to other regions is positive

However, demand-side tailwinds for graphite electrode can probably come from closure of inefficient/ polluting steel production units (mainly blast furnance) in China and replacement of this supply by increased capacity (both blast furnance and electric arc furnance) in other regions. As per HEG management estimates and based on our calculation, about 8-9 percent incremental increase in demand for graphite electrode is possible due to developments in China.

Source: HEG

Needle coke shortage: both boon and bane

Needle coke (two-thirds of raw material cost) prices have also increased of late in tandem with improved steel industry dynamics and graphite electrodes prices. Supply constraint of needle coke has also contributed to the surge (USD 3200 from USD 450 a year ago). Recently, temporary shutdown in the Graftech needle coke manufacturing plant due to the Harvey hurricane also had an impact.

Limited availability of needle coke discourages the new capacity addition in graphite electrode industry and so benefits existing players. However, it doesn’t take away the fact that rising needle coke prices caps the margin expansion that graphite electrode manufacturers can expect in the current context.

Global needle coke capacity (kT)

Source: Graftech,

Valuations expensive at consensus assumptions for pricing trends

Looking at the financials of Indian graphite electrode manufacturers, one finds that valuations are rich if we pencil in consensus expectations for graphite electrode and needle coke pricing contracts next year.

HEG, which is currently running at 71 percent capacity utilization, would also gain from operational leverage. Graphite India already running at 95 percent capacity would benefit from better operational efficiency and balance sheet.

Having said that both HEG and Graphite India are currently running quite ahead of the median expectations for product and raw material prices. While both companies benefit from the tailwind of improving end market and supply-demand imbalance, capacity curtailment in China and needle coke prices are the factors to watch out for.

---------------------

Credit: Anubhav Sahu, MC research